Perry, GA Real Estate Snapshot | December 2025: Demand Held, Financing Led, and the Market Found Its Center

December real estate activity in Perry, GA did not feel flashy — and that’s exactly why the data matters.

While November highlighted pricing tension between buyers and sellers, December showed something more meaningful for long-term outlook: Perry’s buyer base stayed engaged, financing remained active, and the market revealed a clear center of gravity rather than drift or decline.

This wasn’t a market trying to accelerate.

It was a market confirming where it works.

Here’s what December is actually telling us — and what that means for 2026 in Perry.

📊 December 2025 Snapshot:

(Central Georgia MLS)

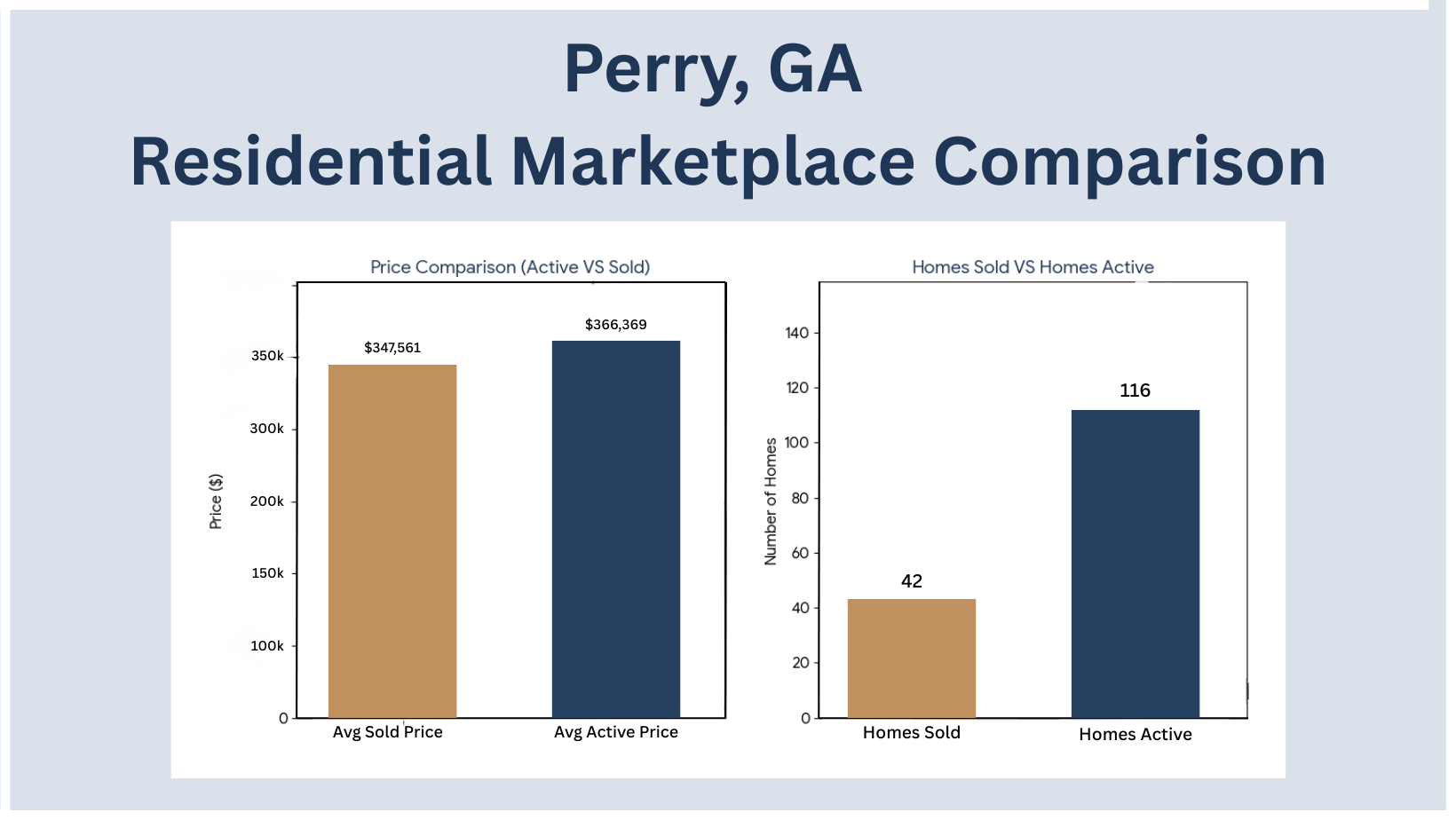

• 42 homes sold

• $14,597,574 total volume

• Average Sold Price: $347,561

• Median Sold Price: $297,417

• Average Sold DOM: 38 days

For a traditionally slower month, Perry maintained strong closings and a sub-40-day average time to sell. That alone tells us buyers were not on pause — they were selective, prepared, and moving with intent.

📌 Active Inventory Snapshot – What the Market Is Willing to Absorb?

As of month-end:

• 116 active single-family detached listings

• $42,498,853 active volume

• Average Active Price: $366,369

• Median Active Price: $313,817

• Average Active DOM: 79 days

The most important detail here is not the spread between active and sold averages — it’s the median alignment.

December’s median sold price (~$297K) sits within striking distance of the median active price (~$314K). That tells us Perry buyers are still shopping close to asking prices within the market’s affordability core, even as they pass on listings outside that band.

⭐ The Perry Market Signal in December:

December confirms that Perry is not drifting — it is anchored.

Buyers demonstrated clarity around value bands rather than hesitation. Activity clustered tightly near the high-$200s / low-$300s, while higher-priced homes still sold — just with longer decision cycles and more underwriting scrutiny.

This is the defining trait of a financing-driven, owner-occupant market — and it’s exactly why Perry behaves differently than Kathleen or Bonaire.

📍 Submarket Performance: Perry & South Houston County:

Perry & South Houston County Combined

• 42 total residential sales

• Average Sold Price: $347,561

• Average DOM: 38

Breaking that down further:

Non-Co-Op Sales

• 8 homes

• Avg Price: $240,239

• Avg DOM: 17

These sales show that lower-priced inventory remains tight. Entry-level and lower-mid homes did not linger, even in December.

Co-Op Sales

• 34 homes

• Avg Price: $372,814

• Avg DOM: 43

Move-up homes continued to transact, but buyers took more time — a sign of evaluation, not retreat.

💰 Where December Buyers Concentrated?

December pricing sorted into three clear functional lanes:

$220K–$280K (Supply-Constrained Lane)

• Fastest movement

• FHA & VA activity strong

• Limited inventory pressure

$285K–$330K (Core Perry Market)

• Highest transaction density

• Broad buyer pool

• Pricing clarity strongest

$350K+ (Deliberate Buyer Lane)

• Still active

• Longer timelines

• Financing and condition matter more

This reinforces Perry’s role as the affordability anchor for South Houston County — not the ceiling market, but the foundation.

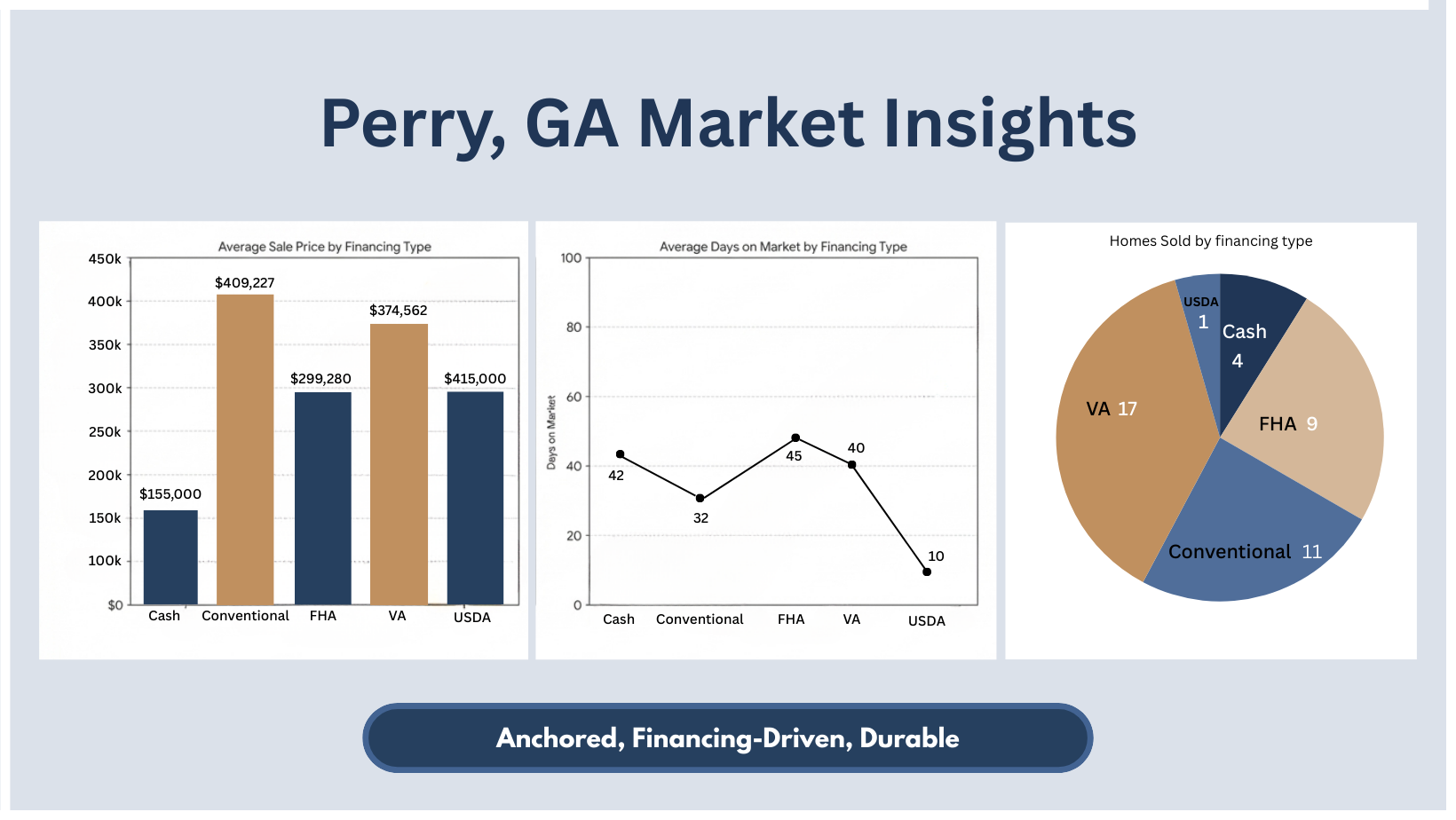

💳 How Buyers Are Financing in Perry?

What this tells us?

• VA buyers are not marginal — they are central

• FHA demand confirms affordability sustainability

• Cash is not propping up pricing

This matters heading into 2026. Markets supported by real financing tend to move more predictably — and more safely — than markets driven by speculative capital.

🧭 Market Feel:

Perry in December felt:

• Defined

• Financing-led

• Buyer-intentional

• Not emotional

• Not speculative

• Grounded in affordability

This is not a market searching for direction.

It’s a market operating within known boundaries.

🕰 What December Signals for Perry in 2026?

Heading into 2026, December’s data suggests:

For Buyers:

• Strong competition remains below $300K

• Negotiation increases above the median

• Financing readiness outweighs aggressiveness

For Sellers:

• Demand does not stretch — it concentrates

• Homes aligned with Perry’s core price bands will outperform

• Higher-end homes can sell, but patience becomes part of the equation

For the Market Overall:

• Perry is positioned for stability, not volatility

• Transaction volume should remain dependable

• The market rewards clarity more than optimism

🔎 The Takeaway

December didn’t change Perry’s identity — it confirmed it.

Why this matters for 2026:

• Perry’s demand is income-supported, not speculative

• Its pricing center is well-defined

• Its market cycles tend to endure rather than swing

📞 Thinking About Your Next Move?

Whether you’re planning a 2026 sale, considering a purchase, or simply want to understand where your home fits inside Perry’s true demand bands, I’m here to help you interpret the data — not just react to it.

William Walton-Dean | Walton Dean Realty

📱 478-371-7069

Your dreams. Our dedication. A luxury experience tailored for you