Warner Robins, GA Real Estate Snapshot | December 2025: The Market Showed Its Mechanics

December doesn’t usually tell you where a market is going.

It tells you what still works when urgency fades.

In Warner Robins, December answered that question clearly. Transactions didn’t rely on hype, seasonal momentum, or speculative buyers. Instead, the market functioned through breadth—multiple buyer types, multiple price lanes, and multiple neighborhoods all contributing to volume.

That matters heading into 2026, because markets that still transact cleanly in December tend to be markets with internal balance, not artificial support.

Here’s what December’s data is actually revealing.

📊 December 2025 Snapshot:

(Central Georgia MLS)

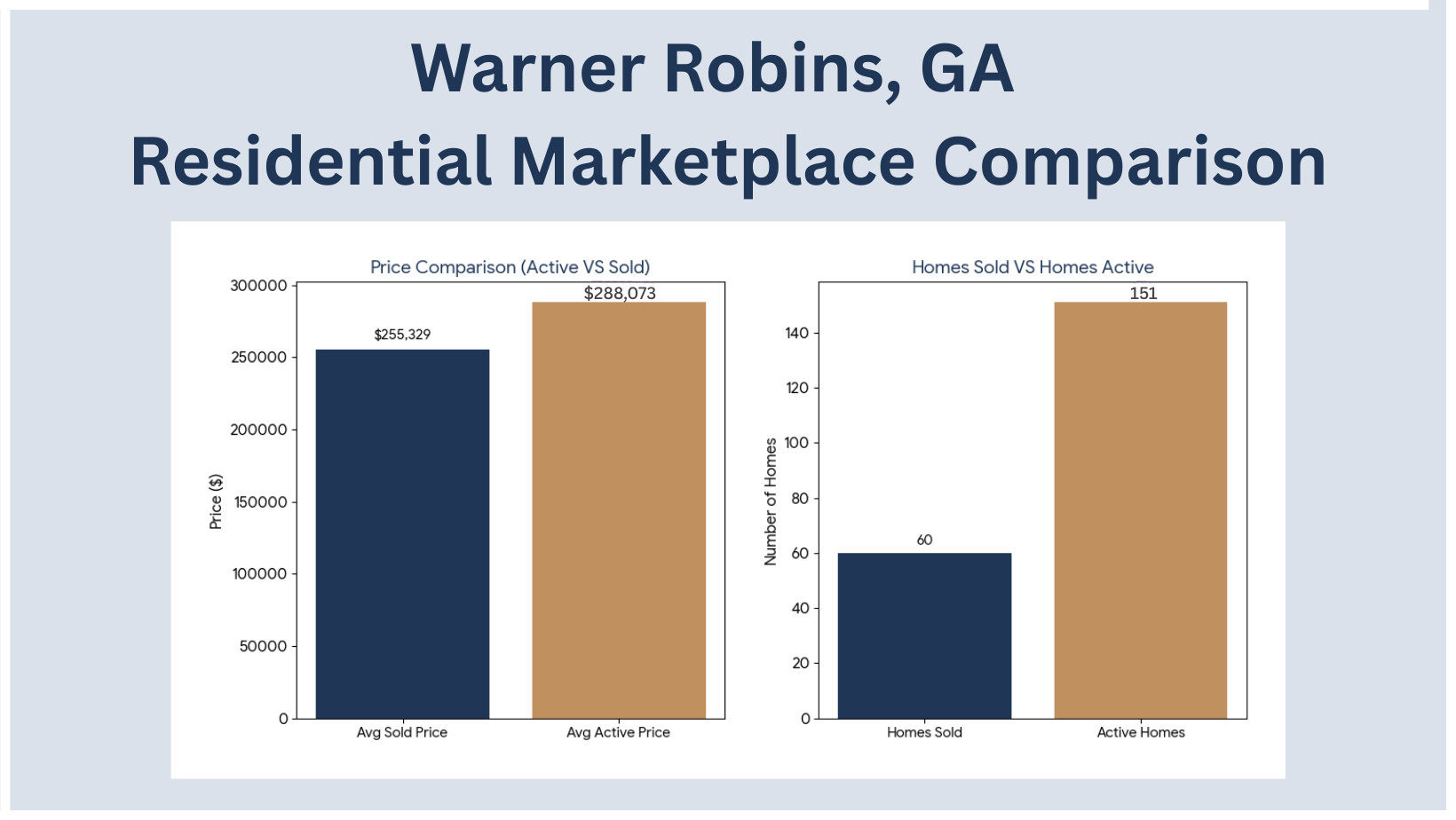

• 60 residential homes sold

• $15,319,768 in total volume

• Average Sold Price: $255,329

• Median Sold Price: $238,200

• Average Sold DOM: 39 days

Sixty closings with sub-40-day market time in December is not accidental. It indicates that buyers weren’t waiting for direction—they already knew where value was and acted accordingly.

📌 Active Inventory: Evidence of Absorption, Not Backlog

December closed with:

• 151 active single-family detached listings

• Average Active Price: $288,073

• Median Active Price: $247,000

• Average Active DOM: 69 days

The meaningful detail here is where activity concentrates, not the headline inventory count.

Median active pricing remains closely aligned with median sold pricing, which tells us the center of the market is still clearing inventory. Listings that extend DOM are overwhelmingly located outside that center—either above the dominant price band or misaligned with neighborhood expectations.

This is not excess inventory.

It is sorting.

⭐ What December Revealed About Warner Robins?

December showed that Warner Robins does not depend on a single buyer group or a narrow pricing window to function.

Instead, the market continues to operate through distribution:

· Affordable homes transact quickly

· Mid-range homes transact consistently

· Higher-priced homes transact selectively

That layered demand is what allows Warner Robins to absorb inventory month after month without sharp price corrections.

This structure is especially important for 2026, when buyer caution is expected to remain elevated.

📍 Neighborhood Performance: Still the Market’s Steering Wheel

December reinforced that outcomes in Warner Robins are determined locally, not citywide.

Watson Blvd North

• 21 sales

• Average Price: $222,892

• Average DOM: 35

This area continues to attract value-driven buyers. Homes meeting baseline condition expectations moved without delay.

Watson Blvd South → Highway 96

• 37 sales

• Average Price: $272,950

• Average DOM: 40

This corridor carried most of December’s volume. Buyers here remained active but deliberate, with condition and layout influencing decision time more than price alone.

Highway 96 → Mossy Creek

• Limited sample

• Average Price: $264,888

• Average DOM: 25

Smaller volume, but strong performance where newer or well-maintained inventory entered the market.

The takeaway: location and product type matter more than month or season.

💰 Where Buyers Actually Committed in December?

December purchases clustered into three functional ranges:

Below $230K

• Strong affordability demand

• FHA and cash activity

• Short decision timelines

$240K–$290K

• Largest share of transactions

• Conventional and VA buyers dominant

• Predictable absorption

Above $300K

• Still active

• Longer evaluation cycles

• Neighborhood-specific performance

This pattern confirms that Warner Robins does not rely on price inflation to sustain activity—it relies on volume across segments.

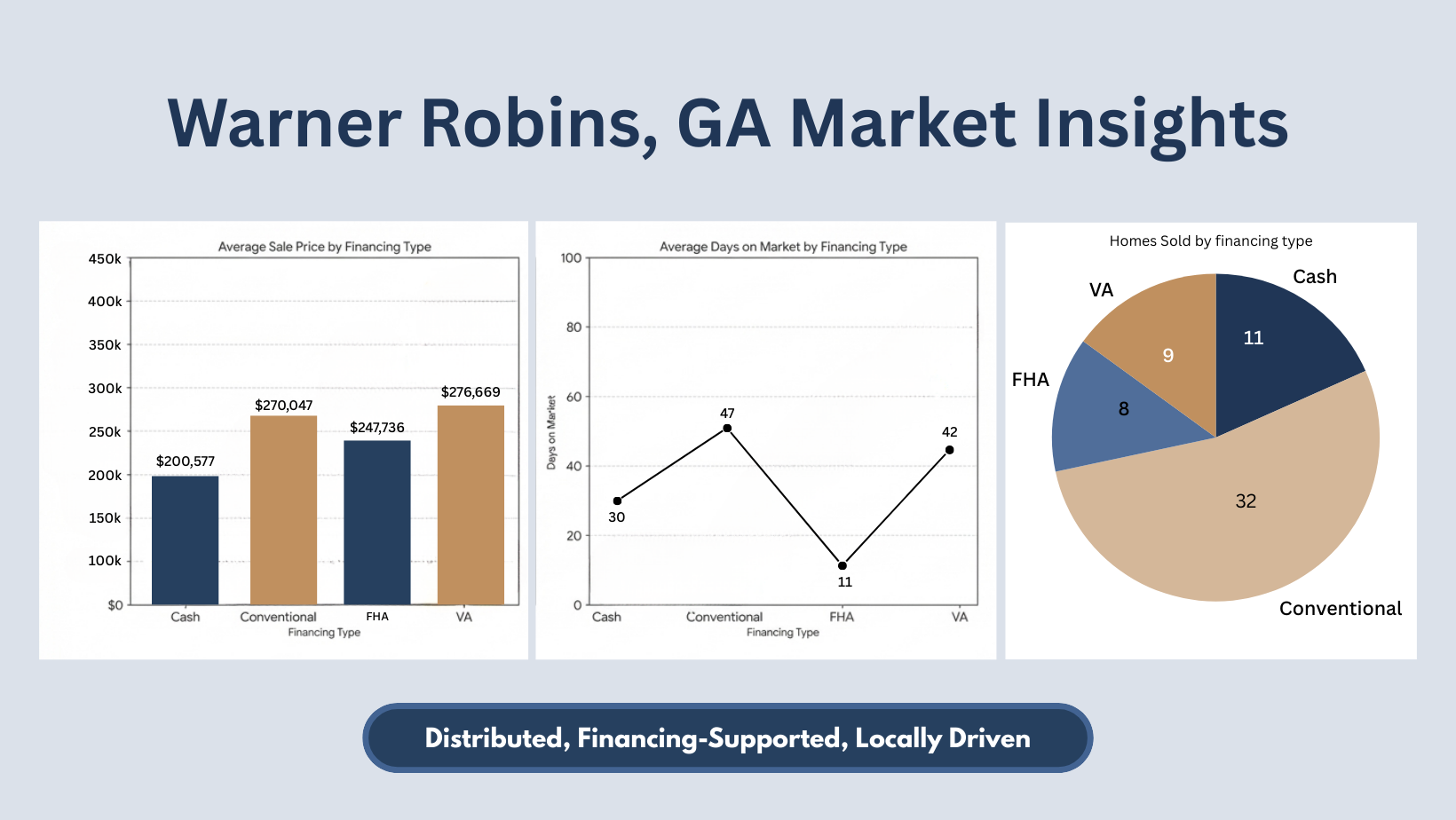

💳 Financing Mix: Why This Market Holds Its Shape?

December’s financing mix is one of the strongest indicators for 2026.

This is a market supported by:

· Underwritten buyers

· Income-backed purchasing power

· Programs designed for primary residences

Minimal reliance on speculative cash keeps pricing grounded and prevents sharp swings.

🧭 Market Character in December

Warner Robins in December felt:

• Operational

• Distributed

• Buyer-informed

• Neighborhood-driven

• Resistant to volatility

This is what a normal market looks like—and that’s a strength, not a limitation.

🕰 What December Signals for Warner Robins in 2026?

December’s performance suggests the following for the year ahead:

For Buyers:

• Opportunity will come from choice, not urgency

• Negotiation increases above the mid-range

• Neighborhood selection will matter more than timing

For Sellers:

• Results will be dictated by alignment with local demand

• Condition and layout will carry more weight than list strategy

• Homes outside dominant price bands will require patience

For the Market Overall:

• Expect consistency, not acceleration

• Volume should remain dependable

• The market is positioned to adapt, not correct

🔎 The Takeaway

December clarified how Warner Robins actually works.

What this means for 2026:

Warner Robins isn’t built for spikes or drops.

It’s built to function.

And markets that function well in December tend to hold their footing when conditions change.

📞 Thinking About Your Next Move?

If you’re planning a 2026 purchase, sale, or relocation, understanding where your home fits inside Warner Robins’ internal structure matters more than watching headlines. I’m here to help you interpret that position clearly and strategically.

William Walton-Dean | Walton Dean Realty

📱 478-371-7069

Your dreams. Our dedication. A luxury experience tailored for you.