Want To Sell Your Home? Start Early: What Today’s Market Means for Longtime Owners

For many homeowners, today’s market is vastly different from the one they last sold in, but that could be a good thing if it’s approached with the right expectations. Longtime owners have built substantial equity, and with new tools, next spring could be an opportune moment to sell despite a shifting market, especially if the preparations start now.

Market then vs. now: A different landscape

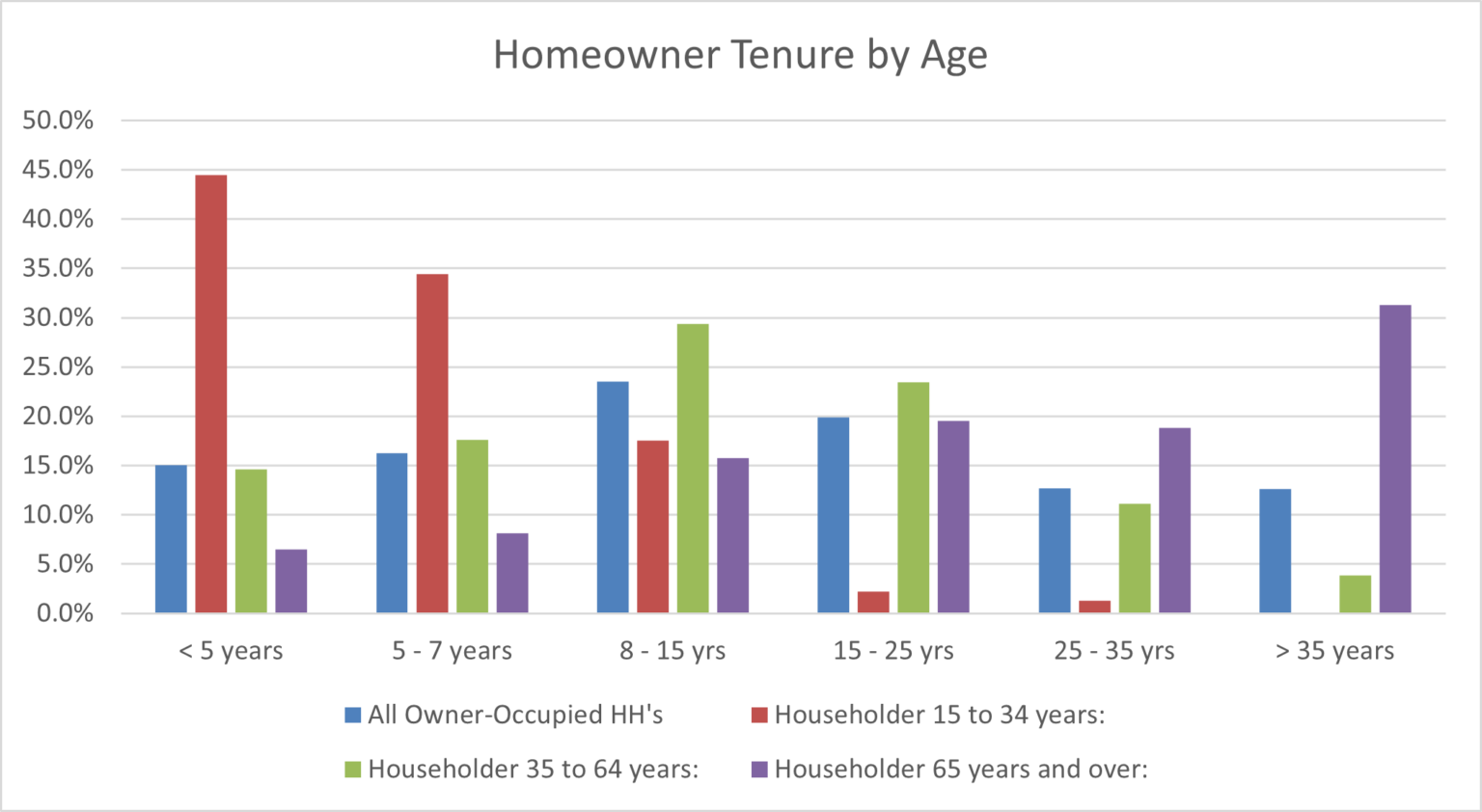

Nearly half (45.2%) of today’s homeowners have lived in their home for more than 15 years, and 1 in 4 for over 25 years. Among the oldest homeowners, the trend is even stronger: Roughly one-third of all homeowners are aged 65-plus, and about 70% of these households moved in before 2009, and roughly half before 2000. In other words, the typical 65-plus homeowner has lived in their home for more than a quarter-century.

Source: 2023 1-year ACS

Over that time, the housing market has transformed. Existing-home sales prices have tripled, from $145,000 in June 2000 to $435,300 in June 2025, according to the National Association of Realtors®. Mortgage rates are now slightly lower than they were in much of the 1990s, though higher than the unusually low levels of the early 2000s through 2023. Meanwhile, median household income has climbed from $42,000 to just under $80,000, meaning home values have far outpaced income growth, reshaping affordability.

Source: ACS 1-yr HH Income, NAR Existing-Home Sales Price

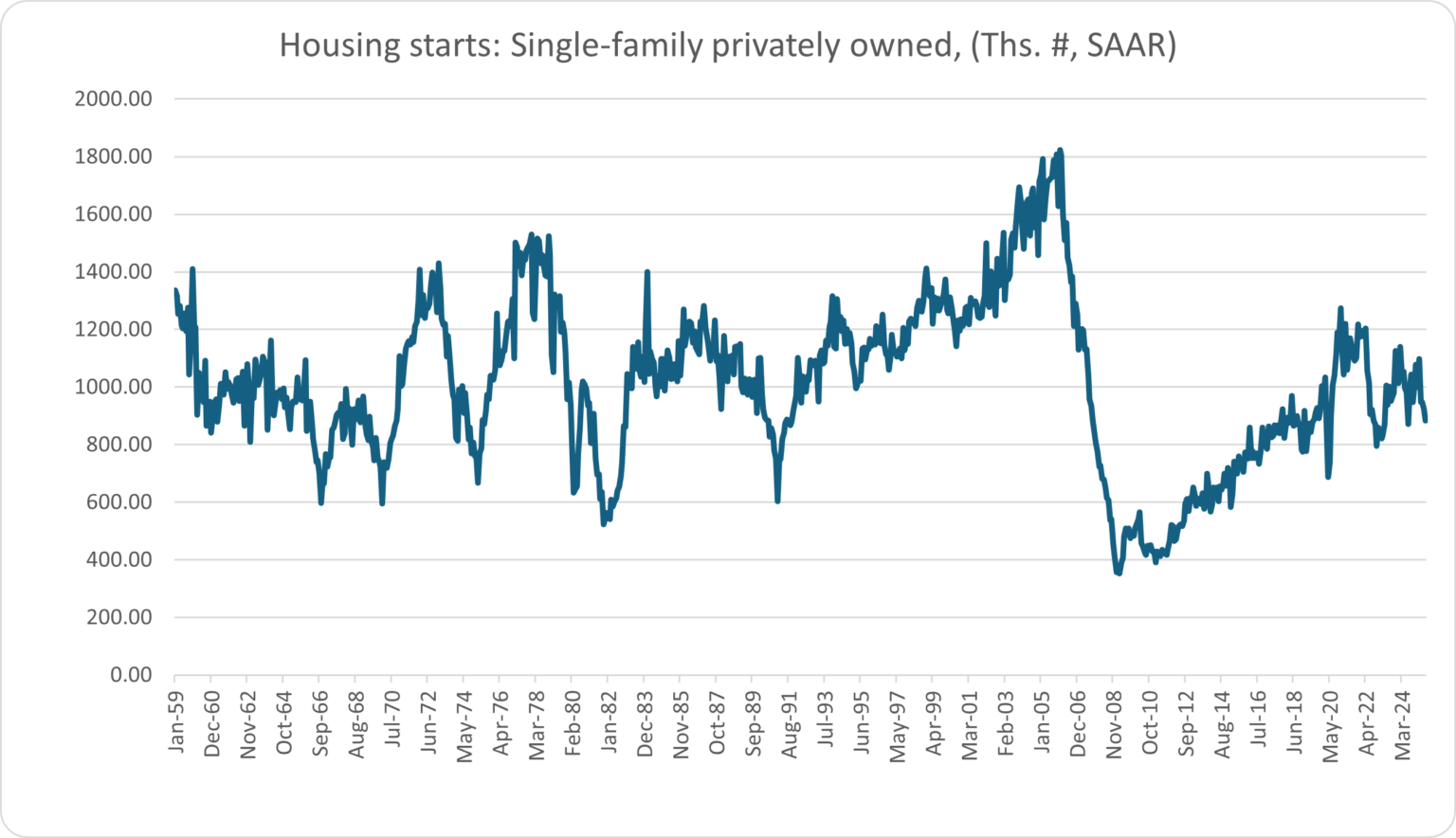

New-home construction plunged from 2006 to 2009 after early-2000s overbuilding and risky lending fueled the housing crash. Recovery over the past decade has been slow, with builder activity trailing household formation and leaving an estimated shortfall of 4 million homes. This structural supply-demand imbalance has driven home prices higher, vacancy rates lower, and affordability challenges deeper.

Source: Census Bureau

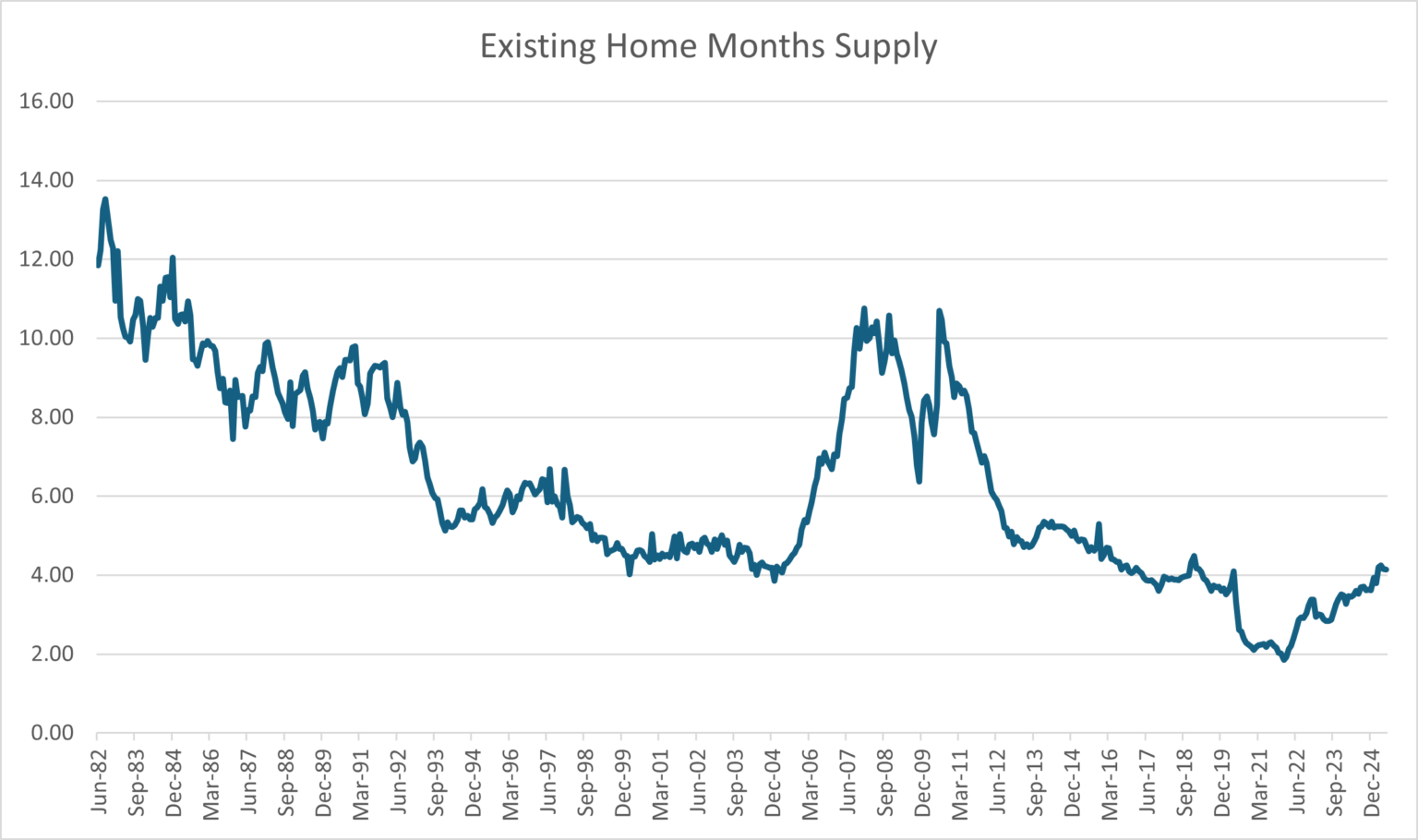

The past five years have intensified these pressures. COVID-19 pandemic-era demand collided with limited supply, sending prices soaring. Rising mortgage rates then sidelined many buyers, leading to higher inventory, a shift toward balance that’s tempered by persistent affordability constraints. More homes are on the market, but many buyers remain unable to take advantage, creating a tougher environment for sellers.

Source: National Association of Realtors

Today’s market is a far cry from the late ’90s: Buyers face fewer affordable options, and sellers may encounter less eager buyers. Nevertheless, at 4.1 months of supply in June 2025, sellers are still in a relatively good position compared to the turn of the millennium when months of supply was 4.7 in June 1999 and 2000, signaling somewhat more sellers relative to buyers. Moreover, for longtime owners, decades of appreciation mean substantial potential gains when selling.

You’ve built more equity than you realize

If you’ve owned your home for 10, 20, or even 30 years, you’re likely sitting on a financial asset that’s grown far more valuable than you think. Home prices across the U.S. have risen dramatically over the past few decades, in many markets doubling, tripling, or more since the early 2000s. That long-term appreciation, combined with years of mortgage payments steadily reducing your balance, has likely left you with record-high equity.

For example, a typical homeowner who purchased a median-priced home in 2005 has seen their property’s value increase by roughly 90%, translating to hundreds of thousands of dollars in potential profit. Put differently, the median U.S. existing-home sale price climbed $206,300 between June 2005 and June 2025, boosting the typical homeowner’s equity. And in many regions, the jump is even greater, especially for those who bought before the housing boom of the early 2000s.

Homeowner Equity

Source: Realtor.com analysis using NAR Home Sale Price Data

This equity isn’t just a number on paper; it’s real wealth you can use. Whether you’re downsizing, relocating, or ready to invest in a new property, selling could allow you to cash in while prices remain historically strong. Though homes are spending longer on the market, longtime homeowners have more flexibility to price strategically and competitively to attract buyer attention and come away with a tidy profit.

The market is shifting, but strategic sellers can still find success

During the pandemic, intense buyer demand far outstripped the number of available homes, allowing many sellers to attract offers quickly without extensive planning. But the market has shifted since the 2020–22 frenzy. By 2025, for-sale inventory climbed back to late-2019 levels, homes in many areas are taking longer to sell, and prices are beginning to soften. In today’s environment, sellers must be more intentional about pricing and presentation to stand out.

While the market has tilted more buyer-friendly nationwide, conditions vary widely by region. In the South and West, inventory is 4.3% and 9.3% higher than pre-pandemic, respectively, giving buyers more options. In contrast, the Midwest and Northeast still trail pre-pandemic supply by 40% and 51.1%, limiting choice for buyers and competition among sellers. Regardless of whether your local market favors buyers, favors sellers, or remains balanced, understanding what buyers want, and what they’re willing to pay, is key to a successful sale.

Spring is traditionally the prime selling season, with demand rising as the weather warms. Sellers who start preparing early can secure the right representation and maximize their home’s appeal before peak season. Recent research from a Realtor.com survey revealed that one of the top regrets recent sellers cite is not interviewing more agents before choosing one. The right agent can offer tailored advice, market insight, and strategies to match today’s shifting conditions, making them an essential partner in achieving the best outcome—underscoring the importance of reviewing options before picking a partner.

Why starting early matters for sellers

A recent survey finds that the typical homeowner expects it will take about 10 months to sell a home in 2025, from deciding to list to closing. Baby boomers are more optimistic, estimating closer to six months. Regardless of which timeline proves accurate, the message is clear: If you’re aiming to sell in 2026, now is the time to start preparing, especially if you want to maximize the spring market’s higher buyer activity.

Respondents overwhelmingly agree that both buyers and sellers enjoy a smoother, more successful experience when they start early. In fact, a recent survey reveals that, for sellers, bringing a real estate agent into the process sooner can pay off significantly. Among those already working with a real estate agent, 36.1% report better access to market information, while 37.1% say their agent not only provided more insight, but also helped set realistic pricing, establish achievable timelines, and streamline the entire process.

In a market that’s more balanced, and in some regions, tilting toward buyers, early planning and professional guidance can make all the difference.

What to do now

Interview multiple agents to find the right fit.

Assess your home’s value and equity position.

Identify needed updates or repairs.

Plan your listing timeline to align with peak spring demand.